BILLS OF EXCHANGE

Bills of Exchange

Meaning of a Bill of Exchange

Define a bill of exchange

Bill of exchange is written order letter in which there is not any condition. Writer's sign will be in it. In this letter, order to other person is given to pay the certain sum of money to the writer of letter or to pay any other authorized person or who has this bill of exchange.

The Nature of Interest of a Bill of Exchange

Explain the nature of interest of a bill of exchange

Essential of a Bill of Exchange

- It should be in written.

- Unconditional order to pay.

- Signed by writer.

- Debtor must be a certain person.

- Payment must be a certain amount.

- Payment must be done on maturity of bill.

- Acceptance must be given by debtor on this bill.

Bills of Exchange and Promissory Notes are treated alike for accounting purposes. That is, both are treated and recorded under the common account “Bills of Exchange”.

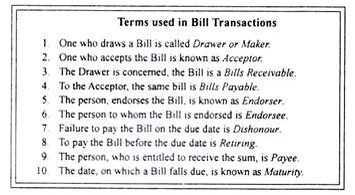

We come across four parties to a Bill:

- (a) Drawer,

- (b) Drawee (Acceptor),

- (c) Endorser, and

- (d) Endorsee.

When a drawer endorses a Bill, which he received from the Acceptor, he becomes Endorser. Endorsee is a person to whom the Bill is transferred. When the endorsee, again, endorses the Bill, he becomes an Endorser and the receiver of the endorsed Bill is an Endorsee.

A bill of exchange or Promissory Note may be treated as Bills Receivable, when payment has to be received against it. Thus, a bill of exchange is Bills Receivable for the drawer as he has to receive the amount. A bill of exchange or Promissory Note may be treated as a Bill Payable, when payment has to be made against it.

Thus, a bill of exchange is a Bill Payable for the drawee (Acceptor). Thus, it is clear that Bills of Exchange or Promissory Notes can be Bills Receivable to one party and Bills Payable to another party.

The Bill in the possession of the Creditor may be dealt with in any one of the following ways:

- One can keep the Bill till the date of maturity and realize the payment against it.

- One can discount the Bill with a bank before its maturity, if he is in need of money.

- One can transfer the Bill, against a debt, to his Creditor by endorsing it.

- One can send the Bill to the bank for collection of amount against it.

We shall discuss the accounting treatment of transactions:

Bill Recieved

Account for bill received

Accrued Interest; Default of Bill; Default or Dishonor ; The Discounting of a Bill of Exchange

Account for: Accrued interest; Default of bill; Default or dishonor; The discounting of a bill of exchange

Drawing, Accepting and Discharge of A Bill:

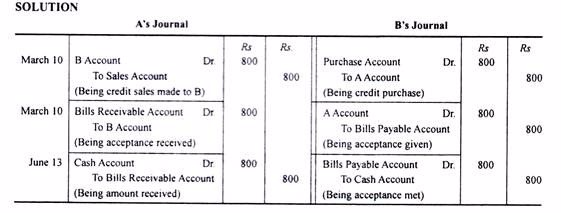

Illustration 1:

On March 10th, A sold goods to B and draws on B a Bill at three months for Rs 800, which B accepts immediately and returns it to A. The Bill is honoured on the due date. Pass entries in the books of both A and B.

Discounting the Bill:

Illustration 2:

A accepted a four months’ draft for Rs 1,000 drawn on him by B on 15th April. The Bill was discounted with the bankers on the next day at 12%. On maturity the Bill was met. Make journal entries in the books of A and B.

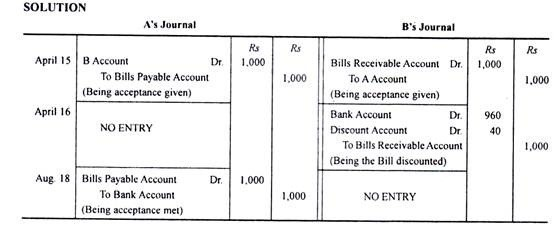

Endorsing the Bill:

On 1st June Ram drew a bill upon Krishna for Rs 500 at four months date. This was duly accepted and payable at Canada Bank. After the acceptance, the Bill was endorsed to Gopal. On the due date, the Bill was honoured. Pass the journal entries in the books of all parties.

Dishonouring the Bill:

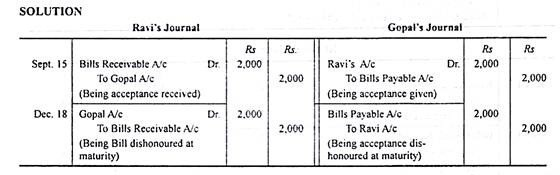

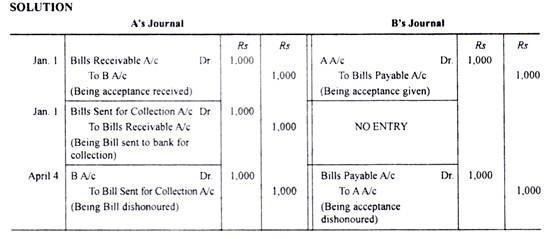

(a) When Drawer is the Holder of the Bill:

Illustration 4:

Mr. Ravi draws a Bill for Rs 2,000 on Gopal on 15th September for three months. On maturity, Gopal failed to honour the Bill. Pass the necessary journal entries in the books of Ravi and Goipal, if he had retained the Bill with him till maturity. (Calicut)

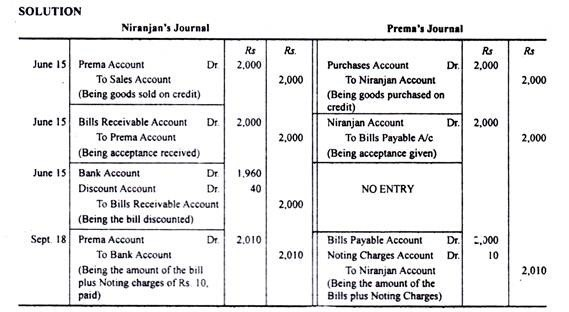

(b) When Banker is the Holder of the Bill:

On 15th June, Niranjan sold goods to Prema, valued at Rs 2,000. He drew a Bill at 3 months for the amount and discounted the same with his bankers at Rs 1,960. On the due date, the Bill was dishonoured and Niranjan paid the bank the amount due plus the noting charges of Rs 10. Pass the journal entries in the books of the two parties. (B.Com Mysore)

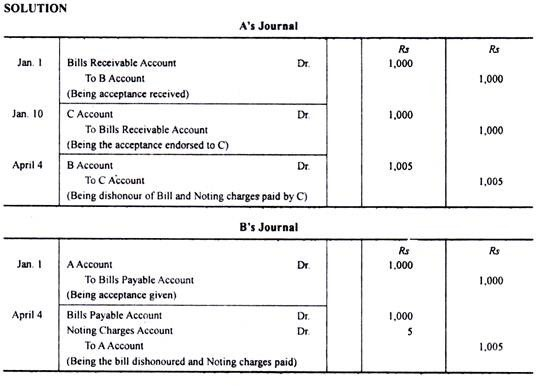

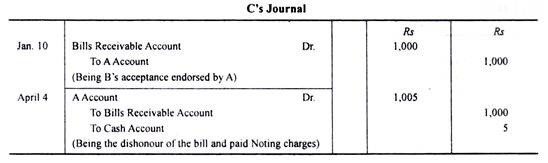

(c) When Endorse is the Holder of the Bill:

On 1st January, A drew a Bill on B for Rs 1,000 payable after three months. B accepted the bill and returned it to A. After 10 days A endorsed the Bill to his Creditor C.

On the due date, the Bill was dishonoured and C paid Rs 5 as noting charges. Record the transactions in the journals of A, B and C.

(d) When the Bill is Sent for Collection:

Illustration 6:

On 1st January, A drew a bill on B for Rs 1,000, payable after three months. Immediately after its acceptance, A sent the Bill to his Bank for collection. On the due date, the Bill was dishonoured.

Record the transactions in the journals of A and B.

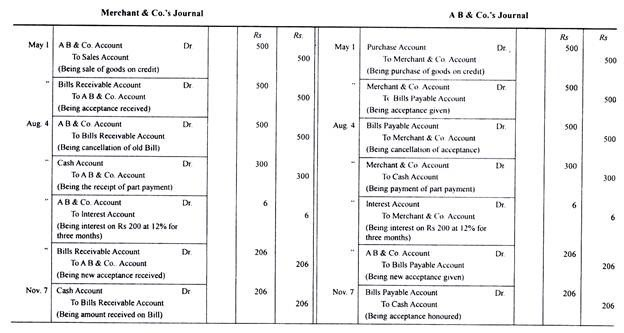

Renewal of the Bills:

Illustration 7:

On 1st May, Merchant & Company sold goods to A B & Co. for Rs 500 and drew upon him a Bill at three months for the amount. A B & Co. accepted the draft and returned to Merchant & Co. On the due date A B & Co. expressed their inability to meet the Bill and offered Rs 300 in cash and to accept a new bill for the balance plus interest at 12% p.a. for three months. Merchant & Co. agreed to the proposal. On maturity, the bill was duly met by A B & Co.

Pass entries in the books of the parties to record the above transactions. (B. Com., Karnataka, Madras)

Solution:

Effects of Dishonour of a Bill:

- When a bill is dishonoured, it becomes valueless and the original position of debtor and creditor is restored between the drawee and the drawer.

- Upon its dishonor, the holder of a bill has a right of action against the drawee or any previous endorser.

- When an endorser makes the payment to the endorsee, he can sue any previous endorser or the drawer.

- Upon dishonour, to avoid confusion and multiplicity of legal actions, generally the drawer takes up the bill and exercises his rights upon the drawee.

- Expenses incurred for establishing the fact of dishonour of a bill (noting charges) are generally paid by the holder, but ultimately these are recoverable from the drawee.

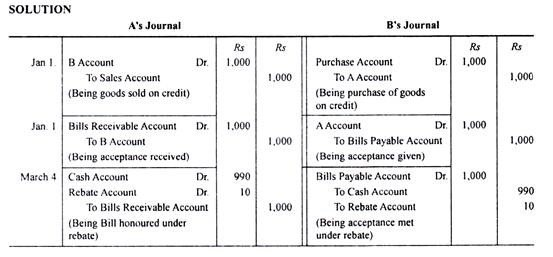

Retiring a Bill under Rebate:

Illustration 8:

On 1st January, A sold goods to B for Rs 1,000 and drew upon him a Bill at three months for the amount. B accepted the Bill and returned it to A. On 4th March, B returned the Bill under rebate of 12% p a.

Record these transactions in the journals of A and B.

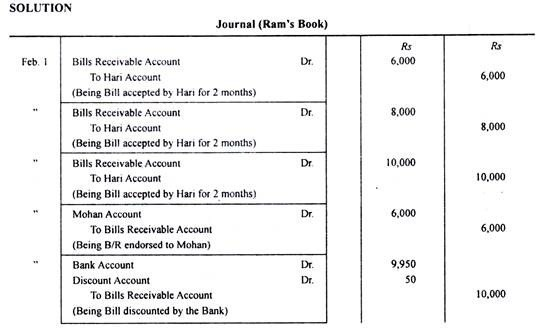

Illustration 9:

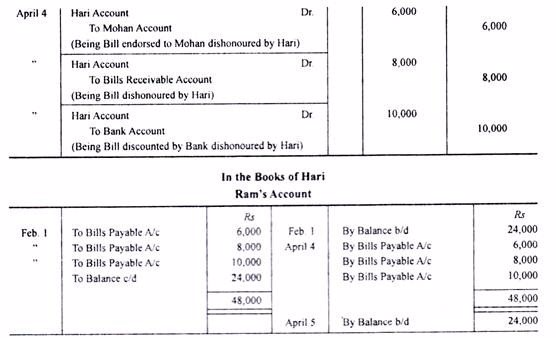

On 1st February, Ram received from Hari three acceptances for Rs 6,000, Rs 8,000 and Rs 10,000 for two months.The first Bill for Rs 6,000 was endorsed to Mohan; the second Bill for Rs 8,000 was held till due date; and the third Bill for Rs 10,000 was discounted for Rs 50.At maturity all the Bills were dishonored. Give journal entries in the books of Ram and the ledger accounts in the books of Hari, in respect of these transactions. (CA)

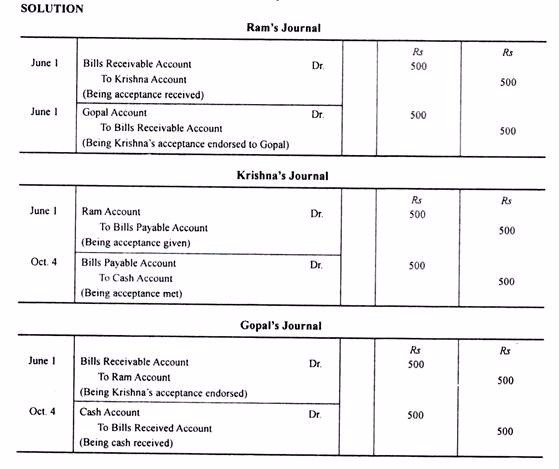

Journalise the following transaction in the books of Nilesh.

- (a) Naresh informs Nilesh that Snajay’s acceptance for `. 8,000 endorsed to Naresh has been dishonoured. Noting charges `. 200.

- (b) Sujit renews his acceptance to Nilesh for `. 4,800 by paying `.1,600 in cash and accepting a new bill for the balance plus interest for 3 months @12% p.a.

- (c) Prakash’s acceptance to Nilesh for `.24,000 retired one month before its due date at a discount of 12% p.a.

- (d) Bank informs Nilesh, the dishonour of Prashant’s acceptance for `. 8,000, discounted with Bank. Noting charges `.160.

Journal of Nilesh

| Date | Particulars | LF | Debit (`.) | Credit (`.) |

| Sanjay A/c…………………………..Dr. To Naresh A/c(Being endorsed bill dishonoured and noting charges paid) | 8,200 | 8,200 | ||

| Sujit A/c………………………………Dr. To Bills Receivable A/c(Being Bills cancelled) | 4,800 | 4,800 | ||

| Sujit A/c………………………………Dr. To Interest A/c(Being interest receivable) | 96 | 96 | ||

| Cash A/c……………………………..Dr. To Sujit A/c(Being part payment received) | 1,600 | 1,600 | ||

| Bills Receivable A/c………………..Dr. To Sujit A/c(Being new bill drawn and accepted due after 3 months) | 3,296 | 3,296 | ||

| Cash A/c………………………………Dr.Discount A/c…………………………Dr. To Bills Receivable A/c(Being Bill Retired) | 23,760240 | 24,000 | ||

| Prashant A/c…………………………Dr. To Bank A/c(Being discounted bill dishonorued and noting charges paid) | 8,160 | 8,160 |

A bill of Exchange with Interest Charges included in the Face Amount

Account for a bill of exchange with interest charges included in the face amount

The Concept of Present Value in Accounting of a Log-term Bill of Exchange

Discuss the concept of present value in accounting of a log-term bill of Exchange

- READ TOPIC 2: Joint Ventures

No comments:

Post a Comment