Inter-Departmental Transfers:

However, if the transfers of goods are made at selling price, then a profit is earned by the supplying department of the same organisation. When the goods, transferred from one department to another, still remain unsold with the transferee department, at the end of the accounting period, there arises a necessity to eliminate the unrealised profit on such stock on hand. This is because, so much of issuing department’s profit (notional) remain unrealised from the viewpoint of the firm as a whole. The reserve will be equal to the profit included in respect of unsold goods at the end of closing.

The entry is:

General Profit and Loss Account Dr.

To Stock Reserve

In certain cases, the transferee department may have some stock in the beginning of the accounting period, against which stock reserve was already created in the previous year, will also be transferred to General Profit and Loss Account by means of Journal entry:

Stock Reserve Account Dr.

To General Profit and Loss Account

Alternatively, a single journal entry can be passed for the unrealised profit on the basis of the difference between unrealised profit included in opening and closing stock.

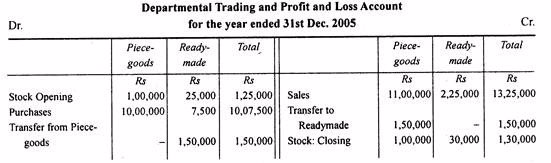

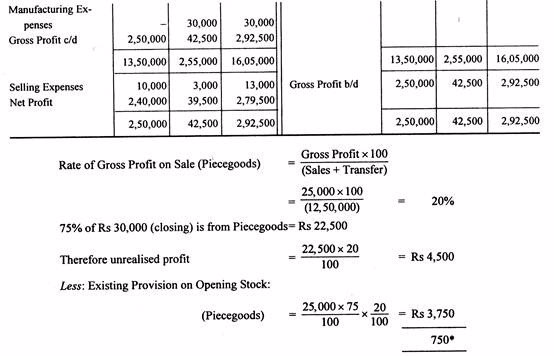

Example 3

Illustration 1:

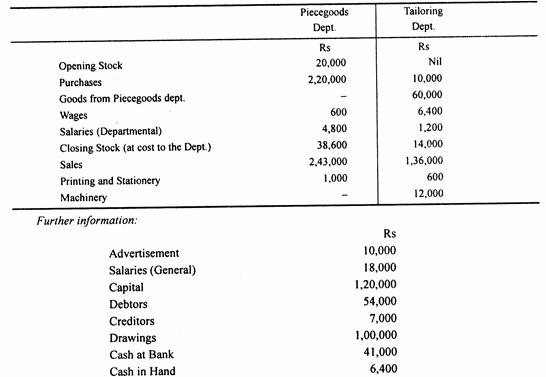

A firm has two departments — Piece goods and readymade dresses. All goods purchased by the readymade department from Piece goods department are charged at the usual selling price.

From the following particulars prepare departmental trading and profit and loss accounts for the year ended Dec. 31, 2005:

The stocks in the readymade department are considered as consisting of 75% cloth supplied from Piece goods dept. and 25% expenses and cloths from outside. The Piece goods department earned gross profit in 2004 at the same rate as in 2005. General expenses of the business as a whole in 2005 amounted to Rs 45,000.

Solution:

Example 4

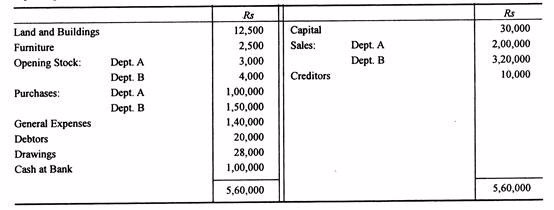

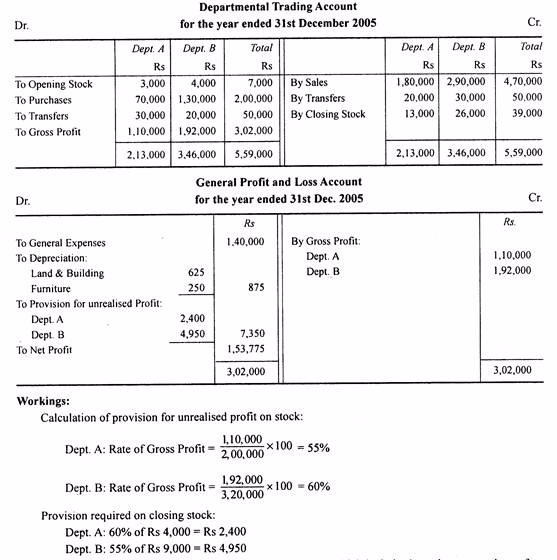

Illustration 2:

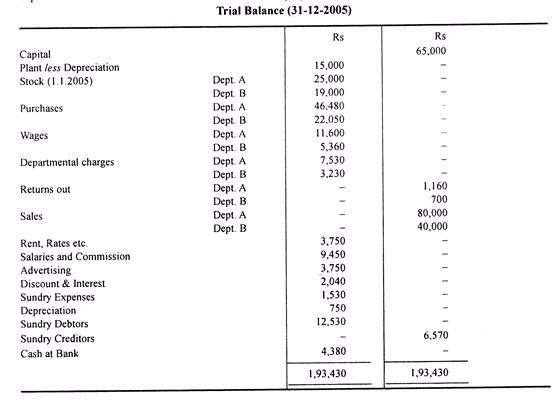

From the following balances extracted from the books of a firm, prepare Departmental Trading and General Profit and Loss Account for the year ended 31st December 2005 and a Balance Sheet as on that date after adjusting the unrealised departmental profits, if any.

Additional information:

- Closing stock of Dept. A – Rs 13,000 including goods from Dept. B Rs 4,000 at cost to Dept. A.

- Closing stock of Dept. B – Rs 26,000-including goods from Dept. ARs 9,000 at cost to Dept. B.

- Sales Dept. A includes transfer of goods to Dept. B of the value of Rs 20,000 and sales of Dept. B includes transfer of goods to Dept. A of the value of Rs 30,000 both at market price to transferor departments.

- Opening stock of Dept. A and Dept. B includes goods to the value of Rs 1,000 and Rs 1,500 taken from Dept. B and Dept. A respectively at cost price to transferor departments.

- Depreciate land and buildings by 5% and furniture by 10% p.a.

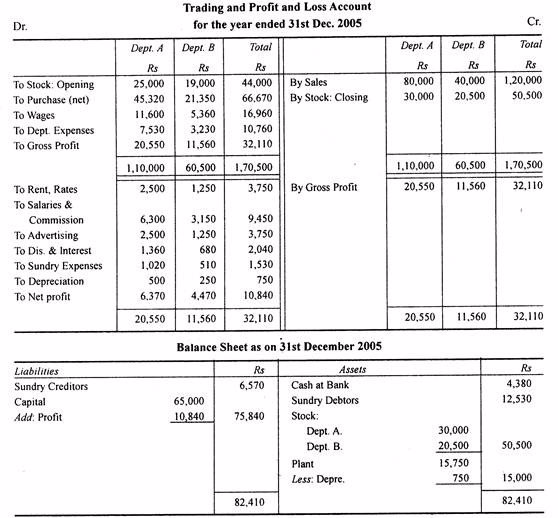

Solution:

N.B. There is no need for any adjustment for opening stock which includes inter-departmental transfers. This is because goods have been valued at cost to the transferor department and not to transferee departments.

Exercise 1

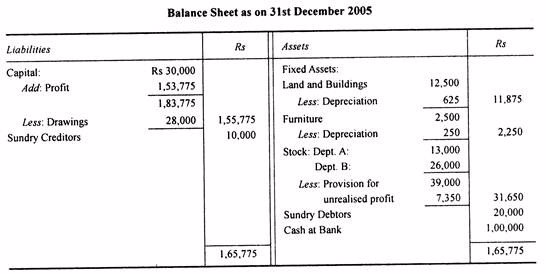

A Department Balance Sheet

Draw a department balance sheet

Example 5

Illustration 2:

From the following particulars you are required to prepare Trading and Profit and Loss Accounts for the year ended 31st December 2005, showing the gross and net profits of each department. Apportion the general expenses of the business on the basis of turnover. Also prepare the Balance Sheet.

Stock in hand Dec. 31, 2005 Dept. A Rs 30.000 and B Rs 20,500.

Total sales are Rs 1.20.000 i.e., Dept. A Rs 80.000 and B Rs 40.000. Proportion of general or indirect expenses chargeable to A 2/3 and B 1/3. (B.Com. Madurai. MS. Bharathiar)

Solution:

- READ TOPIC 6: Elements Of Auditing

No comments:

Post a Comment