BANK RECONCILIATION STATEMENT

Bank Reconciliation Statement

Meaning of Bank Reconciliation Statement

Define Bank reconciliation Statement

Bank reconciliation is the process of matching the balances in an entity's accounting records for a cash account to the corresponding information on a bank statement. The goal of this process is toascertain the differences between the two, and to book changes to the accounting records as appropriate. The information on the bank statement is the bank's record of all transactions impacting the entity's bank account during the past month. A bank reconciliation should be completed at regular intervals for all bank accounts, to ensure that a company's cash records are correct. Otherwise, it may find that cash balances are much lower than expected, resulting in bounced checks or overdraft fees. A bank reconciliation will also detect some types of fraud after the fact; this information can be used to design better controls over the receipt and payment of cash.

If there is so little activity in a bank account that there really is no need for a periodic bank reconciliation, you should question why the account even exists. It may be better to terminate the account and roll any residual funds into a more active account. By doing so, it may be easier to invest the residual funds, as well as to monitor the status of the investment.

At a minimum, conduct a bank reconciliation shortly after the end of each month, when the bank sends the company a bank statement containing the bank's beginning cash balance, transactions during the month, and ending cash balance. It is even better to conduct a bank reconciliation every day, based on the bank's month-to-date information, which should be accessible on the bank's web site. By completing a bank reconciliation every day, you can spot and correct problems immediately. In particular, a daily reconciliation will highlight any ACH debits from the account that you did not authorize; you can then install a debit block on the account to prevent these ACH debits from being used to withdraw funds from the account without your permission.

It is extremely unlikely that a company's ending cash balance and the bank's ending cash balance will be identical, since there are probably multiple payments and deposits in transit at all times, as well as bank service fees (for accepting checks, recording deposits, and so forth), penalties (usually for overdrafts), and not sufficient funds deposits that the company has not yet recorded.

The essential process flow for a bank reconciliation is to start with the bank's ending cash balance, add to it any deposits in transit from the company to the bank, subtract any checks that have not yet cleared the bank, and either add or deduct any other items. Then, go to the company's ending cash balance and deduct from it any bank service fees, NSF checks and penalties, and add to it any interest earned. At the end of this process, the adjusted bank balance should equal the company's ending adjusted cash balance.

Importance of Preparing a Bank Reconciliation Statement

Explain the importance of preparing a bank Reconciliation statement

Importance of Bank Reconciliation

- Preparation of bank reconciliation helps in the identification of errors in the accounting records of the company or the bank.

- Cash is the most vulnerable asset of an entity. Bank reconciliations provide the necessary control mechanism to help protect the valuable resource through uncovering irregularities such as unauthorized bank withdrawals. However, in order for the control process to work effectively, it is necessary to segregate the duties of persons responsible for accounting and authorizing of bank transactions and those responsible for preparing and monitoring bank reconciliation statements.

- If the bank balance appearing in the accounting records can be confirmed to be correct by comparing it with the bank statement balance, it provides added comfort that the bank transactions have been recorded correctly in the company records.

- Monthly preparation of bank reconciliation assists in the regular monitoring of cash flows of a business.

Reasons for the Differences between the Cash Book and the Bank Statement Balances

Give reasons for the differences between the Cash book and the Bank Statement Balances

The reasons for the difference between the balance on the bank statement and the balance on the books includeoutstanding checks,deposits in transit, bank service charges, check printing charges, errors on the books, errors by the bank, electronic charges on the bank statement not yet recorded on the books, and electronic deposits on the bank statement that are not yet recorded on the books.

If an item is on the books but has not yet appeared on the bank statement (outstanding checks, deposits in transit), the items are entered as an adjustment to the balance per bank statement. Outstanding checks are a deduction to the balance per bank; deposits in transit are an addition to the balance per bank.

If an item is on the bank statement but has not yet been entered on the books, the items are entered as an adjustment to the balance per books. Bank service charges, check printing charges, and other electronic deductions that are not yet recorded on the books aredeductions from the cash balance on the books. Electronic deposits not yet on the books are added to the cash balance per books.

Techniques of Choking Accuracy of the Cash Book Recordings in Comparison with Bank Entries and their Resultant Balance

Determine the techniques of choking accuracy of the cash Book recordings in comparison with bank entries and their resultant balance

Preparing a Bank Reconciliation Statement

Following is a sample Bank Reconciliation Statement:

ABC LTD

| Bank Reconciliation Statement as at 31 December 2011 | |||||

| Balance as per corrected Cash Book | 1 | xxx | |||

| Add: | |||||

| Unpresented Cheques | 2 | xxx | |||

| Less: | |||||

| Deposits in Transit | 3 | (xxx) | |||

| Errors in Bank Statement | 4 | (xxx) | |||

| Balance as per Bank Statement | Xxx | ||||

1. Balance as per corrected Cash Book:

This is the starting point of a bank reconciliation. Corrected bank balance is calculated by adjusting the cash book ledger balance for transactions that are recorded by the bank but not by the entity as shown below:

| Balance as per Cash Book | xxx | |||

| Add: | ||||

| Direct Credits | 5 | xxx | ||

| Interest on Deposit | 6 | xxx | ||

| Less: | ||||

| Bank Charges | 7 | (xxx) | ||

| Direct Debits | 8 | (xxx) | ||

| Standing Order | 9 | (xxx) | ||

| Errors in Cash Book | 10 | (xxx) | ||

| Balance as per corrected Cash Book | Xxx | |||

Bank Reconciliation Terminology

The key terms to be aware of when dealing with a bank reconciliation are:

- Deposit in transit. Cash and/or checks that have been received and recorded by an entity, but which have not yet been recorded in the records of the bank where the entity deposits the funds. If this occurs at month-end, the deposit will not appear in the bank statement, and so becomes a reconciling item in the bank reconciliation. A deposit in transit occurs when a deposit arrives at the bank too late for it to be recorded that day, or if the entity mails the deposit to the bank (in which case a mail float of several days can cause a delay), or the entity has not yet sent the deposit to the bank at all.

- Outstanding check. A check payment that has been recorded by the issuing entity, but which has not yet cleared its bank account as a deduction from cash. If it has not yet cleared the bank by the end of the month, it does not appear on the month-end bank statement, and so is a reconciling item in the month-end bank reconciliation.

- NSF check. A check that was not honored by the bank of the entity issuing the check, on the grounds that the entity's bank account does not contain sufficient funds. NSF is an acronym for "not sufficient funds." The entity attempting to cash an NSF check may be charged a processing fee by its bank. The entity issuing an NSF check will certainly be charged a fee by its bank.

Bank Reconciliation Procedure

The following bank reconciliation procedure assumes that you are creating the bank reconciliation in an accounting software package, which makes the reconciliation process easier:

- Enter the bank reconciliation software module. A listing of unclear checks and unclear deposits will appear.

- Check off in the bank reconciliation module all checks that are listed on the bank statement as having cleared the bank.

- Check off in the bank reconciliation module all deposits that are listed on the bank statement as having cleared the bank.

- Enter as expenses all bank charges appearing on the bank statement, and which have not already been recorded in the company's records.

- Enter the ending balance on the bank statement. If the book and bank balances match, then post all changes recorded in the bank reconciliation, and close the module. If the balances do not match, then continue reviewing the bank reconciliation for additional reconciling items. Look for the following items:

- Checks recorded in the bank records at a different amount from what is recorded in the company's records.

- Deposits recorded in the bank records at a different amount from what is recorded in the company's records.

- Checks recorded in the bank records that are not recorded at all in the company's records.

- Deposits recorded in the bank records that are not recorded at all in the company's records.

- Inbound wire transfers from which a lifting fee has been extracted.

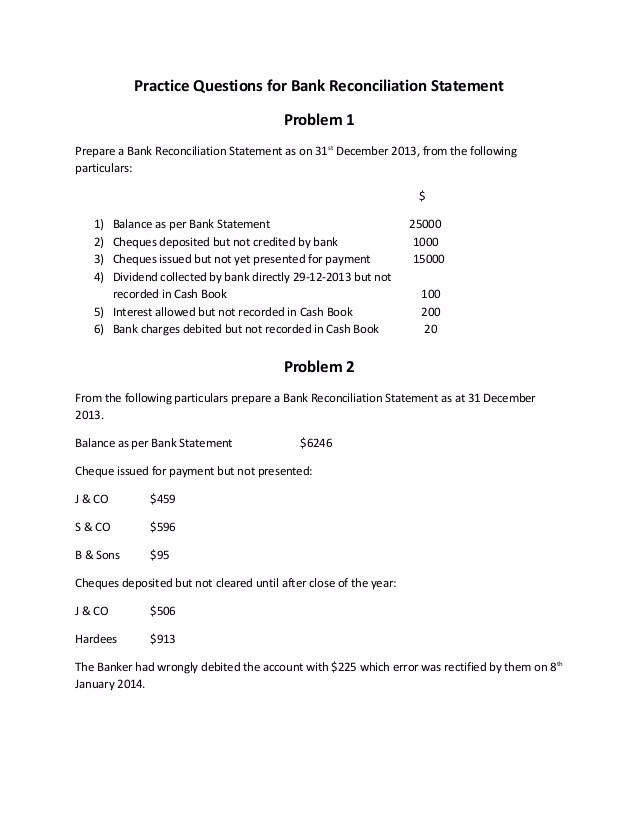

Bank Reconciliation Problems

There are several problems that continually arise as part of the bank reconciliation, and which you should be aware of. They are:

- Uncleared checks that continue to not be presented. There will be a residual number of checks that either are not presented to the bank for payment for a long time, or which are

- never presented for payment. In the short term, you should treat them in the same manner as any other uncleared che

- cks - just keep them in the uncleared checks listing in your accounting software, so they will be an ongoing reconciling item. In the long term, you should contact the payee to see if they ever received the check; you will likely need to void the old check and issue them a new one.

- Checks clear the bank after having been voided. As noted in the preceding special issue, if a check remains uncleared for a long time, you will probably void the old check and issue a replacement check. But what if the payee then cashes the original check? If you voided it with the bank, the bank should reject the check when it is presented. If you did not void it with the bank, then you must record the check with a credit to the cash account and a debit to indicate the reason for the payment (such as an expense account, or an increase in a cash account or decrease in a liability account). If the payee has not yet cashed the replacement check, you should void it with the bank at once to avoid a double payment. Otherwise, you will need to pursue repayment of the second check with the payee.

- Deposited checks are returned. There are cases where the bank will refuse to deposit a check, usually because it is drawn on a bank account located in another country. In this case, you must reverse the original entry related to that deposit, which will be a credit to the cash account to reduce the cash balance, with a corresponding debit (increase) in the accounts receivable account.

Another possibility that may be causing problems is that the dates covered by the bank statement have changed, so that some items are included or excluded. This situation should only arise if someone at the company requested the bank to alter the closing date for the company's bank account.

A bank statement or account statement is a summary of financial transactions which have occurred over a given period on a bank account held by a person or business with a financial institution.Bank statements have historically been and continue to be typically printed on one or several pieces of paper and either mailed directly to the account holder, or kept at the financial institution's local branch for pick-up. In recent years there has been a shift towards paperless, electronic statements, and some financial institutions offer direct download into account holders accounting software.Some ATMs offer the possibility to print, at any time, a condensed version of a bank statement, commonly called a transaction history, or a transaction history may be viewed on the financial institution's website or available via telephone banking.

Unpresented cheque is a check that was written but has not yet been paid by the bank on which it is drawn. An unpresented checkis also referred to as an outstandingcheck or a check that has not yet cleared the bank.Outstanding checks are deducted from the balance per the bank in order to arrive at the adjusted or corrected balance per bank.When a checkiswritten, it will be recorded as a credit to the Cash account in thecompany's general ledger. Whether the check clears the bank or not, the company's Cash account balance is proper.The Cash account balance will be presented on thebalance sheet without any adjustment for unpresented or outstanding checks.

Uncredited check: is a check that has been presented to the bank but still are under process by the bank. The customer account has been debited already.

Example 1

Example !: balance of $4,000.00 <!-- [if !supportLineBreakNewLine]--> <!--[endif]-->

His bank statement showed a balance of $4,270.00 <!-- [if !supportLineBreakNewLine]--> <!--[endif]-->

On comparison the following were found: <!-- [if !supportLineBreakNewLine]--> <!--[endif]-->

- check issued amounting to $2,500.00 has not been cashed

- the bank rejected checks amounting to $140.00

- standing order for a staples order of $700.00 was not noted.

- a customer paid $170.00 directly into the bank without any notice to us.

- bank charges of $160.00 were entered in the bank statement only.

- a dividend of $250.00 was paid directly into the bank and not recorded in the cash book

- checks for $1,650.00 were entered into the cash book and deposited in the bank but had not been cleared (deposited)

Prepare a bank reconciliation statement for the month.

Answer:

What do we know? We know that the closing balance at the bank is $4,270 and the closing cashbook balance is $4,000. Our aim is get the cash book balance reconciled with the bank statement balance.

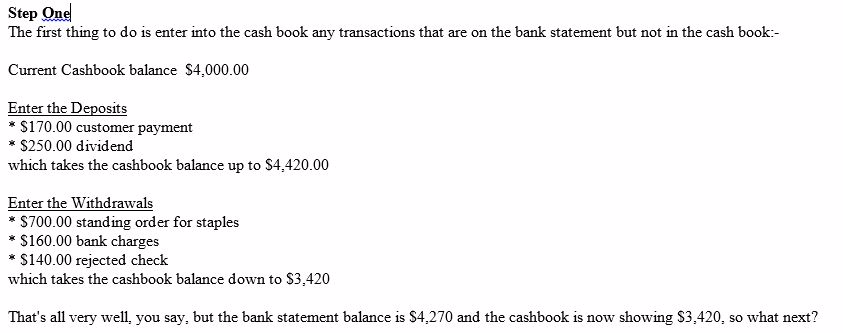

Step One <!-- [if !supportLineBreakNewLine]--> <!--[endif]-->

Step 2

Here is where the reconciliation actually happens.

In the original scenario we are told that $2,500 had not yet been cashed so it does not show on the bank statement, and the $1,650 has been deposited to the bank but not cleared so the bank has not included it in the balance. We cannot add information to the bank statement (like we did with the cashbook) because obviously the bank has control of that so now we need to do our reconciliation table to sort this out, here it is:-

Our reconciliation table above does not affect the actual cashbook balances but does help us to rest assured that all our figures are correct. The outstanding withdrawals and deposits will show up on the next bank statement.

Exercise 1

EXERCISE

- READ TOPIC 4: Government Accounting Terminology

No comments:

Post a Comment